Cut one’s losses Day 48 Idiom of the day

Contents

The demonetisation deeply hurt luxury retailers, as their goods are sold primarily in cash. Sales in the luxury sector have halved since demonetisation, according to estimates by some industry insiders. In 2022, airlines` net losses are expected to be $6.9 billion (an improvement on the $9.7 billion loss for 2022 in IATA`s June outlook). This is significantly better than the losses of $42.0 billion and $137.7 billion that were realised in 2021 and 2020, respectively, IATA said. It’s common for investors to hang onto losers too long because they believe those stocks will rise again. Instead, analyse your portfolio for risky, low-grade stocks with a history of volatility or a new business model and sell off these stocks to reduce the risk.

Jakobs said Philips would double down on patient safety and quality management, improve supply chain operations so it can better fulfil orders, and carry out a restructuring of operations to improve productivity. The firm’s previous CEO stepped down earlier this year after leading the company’s transition from a consumer electronics to medical device manufacturer over the past 12 years. Philips has been bedevilled by the faulty devices that puts users with sleep apnea at risk of inhaling toxic foam. The 1.3-billion-euro ($1.28 billion) write-down for the defective machines pushed the firm into a net loss of the same amount, the company said in a statement. The 1.3-billion-euro ($1.28 billion) charge for the defective machines pushed the firm into a net loss of the same amount, the company said in a statement.

Investment time horizon refers to the amount of time an investment will be held before the money is needed back. Time horizons can help decide the type of stocks you choose to invest in your portfolio. As stock markets around the world crashed in recent weeks, leaving investors poorer by trillions of rupees, both investors and so-called ‘experts’ have been left dumb founded. It’s usually a smart practice to take remedial action before your losses deteriorate. Although it is not always feasible to prevent losses in investing, smart investors acknowledge this and strive to reduce rather than eliminate them. Always keep in mind that you will not trade after you hit your stop loss.

The key is to analyse such missteps and eventually, learn from them. Remember – even the best traders in the market have made mistakes in the past, and strived hard over https://1investing.in/ the years to never repeat them. Investopaper.com is a financial website which provides news, articles, data and reports related to business, finance and economics.

Cut Losses By 21.5 Per Cent In 2016-17

And just like all things related to the markets, time horizons are also dynamic and constantly changing. Over the last year or so, almost every evening on my way back from office, I would meet Mr. Pathak sitting along with his group of friends under our building discussing the stock market. As I passed them, I would often hear them dole out tips and advice on what to buy and sell.

Passenger yields are expected to grow by 8.4 per cent, up from the 5.6 per cent anticipated in June. Propelled by that strength, passenger revenues are expected to grow to $438 billion, up from $239 billion in 2021. Overall revenues are expected to grow by 43.6 per cent compared to 2021, reaching an estimated $727 billion. As the time horizon gets longer, an investor can choose to increase the risk in his portfolio. If the stock market is falling like in the current scenario, a longer time horizon allows more time for the portfolio to recover.

Typically, investors assume that they acquired the stock at the incorrect moment, which is why they have so many significant, unrealized losses. They may feel it was just poor luck, but they almost never believe it was due to their own behavioral biases. Improved prospects for 2022 stem largely from strengthened yields and strong cost control in the face of rising fuel prices.

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services. Pay 20% or « var + elm » whichever is higher as upfront margin of the transaction value to trade in cash market segment. And in challenging times like these, we need your support now more than ever. Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion. AstraZeneca gained 1.4% as it raised its full-year adjusted earnings forecast after beating expectations for quarterly profit and revenue.

An airdrop is a way of sending a token directly to wallets and can be used for various purposes. Airdrops are a common tool for early-stage crypto projects to attract users by offering free tokens and can be used to reward early adopters. Luna 2.0 started trading on May 28 and as of June 3 at 2 p.m., US East Coast time, it was trading at $6.59, down 9% in the last 24 hours, according to CoinGecko and Huobi Global.

NMDC Multiple Announcements: Iron Ore Price Revision, LIC Cuts Stake & More

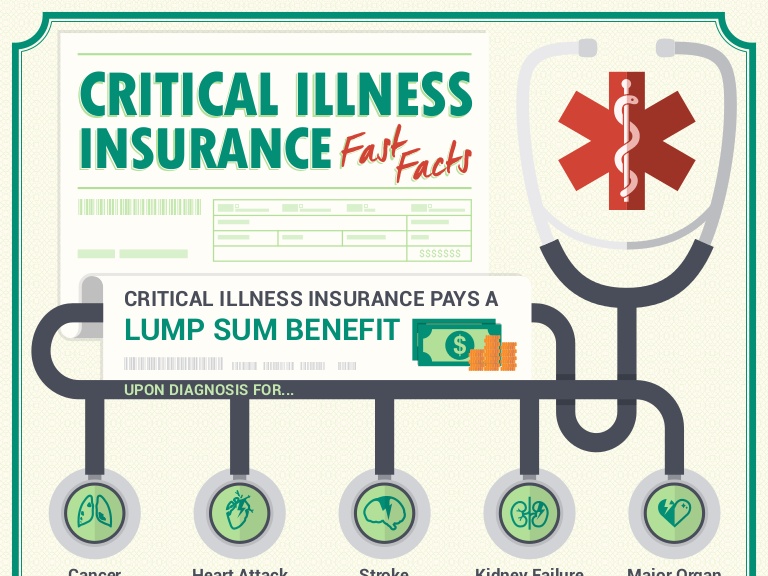

Simply put, it refers to the simple strategy of letting go of losing stocks and instead focusing on the ones that are doing well. With the current state of instability in the market, it is more essential than ever for a stock investor to know when to cut his losses short and how. The volatile market is a cycle of profit and loss, a fight between the Bulls and the Bears.

As we look to 2023, the financial recovery will take shape with a first industry profit since 2019. That is a great achievement considering the scale of the financial and economic damage caused by government imposed pandemic restrictions. But a USD 4.7 billion profit on industry revenues of $779 billion also illustrates that there is much more ground to cover to put the global industry on a solid financial footing. Many airlines are sufficiently profitable to attract the capital needed to drive the industry forward as it decarbonizes. Many retail investors don’t have the expertise to invest in stocks directly. That’s why they make wrong investment decisions and lose their hard earned money.

Investors would be better off selling stocks doing poorly in the market and holding onto stocks that are rising because they are better positioned for the current environment. This doesn’t mean you should sell off all your investments when the market is falling. Such a move can result in missing out on potential gains when the market bounces back. Without a target, greed comes into play and people end up losing their profits made.

It could be an investor saving for retirement while simultaneously saving to pay for his daughter’s college fees or to buy a second home. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month. Update your mobile number & email related party transaction Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge. You must know everything about your trade, and you must also know the reason why are you entering this particular trade.

Aviation ministry increases cap on India-UK flights to 60 services per week from August 16

Investopaper is a financial website which provides news, articles, data, and reports related to business, finance and economics. Under the new crypto tax regime, effective April 1, any income from the “transfer” of a “virtual digital asset” will be taxed at a flat rate of 30%. The Fed minutes also showed policymakers committed to raising rates as high as necessary to bring inflation under control. The Fed has lifted its benchmark overnight interest rate by 225 points this year to a target range of 2.25% to 2.50%. After the release of the minutes, traders of futures tied to the Fed’s policy rate saw a half-percentage-point rate hike as more likely in September.

- If you have no belief in your trading strategy, then you will be switching strategies, and this will slowly blow entire capital in your trading account.

- The important thing to know and understand about day trading is that you cannot avoid losses, but you can only minimize your losses.

- But to become a successful investor, you must set your ego aside, take a small loss and still be fit enough, both financially and mentally, to invest again.

- But with yield improvement in both cargo and passenger businesses, airlines will reach the cusp of profitability,” said Walsh.

The real estate sector index tracked its biggest one-day percentage fall in one week. The MSCI’s broadest index of Asia-Pacific shares outside Japan had dropped 1.4% as investors waited for the U.S. consumer prices data due later in the day. “Resilience has been the hallmark for airlines in the COVID-19 crisis.

Because the country’s tax system is punitive to crypto investing, TerraUSD and Luna token holders who got the new coin — known as Luna 2.0 — in a so-called airdrop face a double whammy. They could be taxed as much as 30% of the value of tokens received and they won’t be able to offset any gains in the new token against losses from the previous one, tax experts said. Investing.com — The S&P 500 cut losses Tuesday, but struggled for direction as Treasury yields continued their march higher following the Bank of Japan’s unexpected hawkish pivot. Peloton’s exit from selling exclusively through its own e-commerce site and global showrooms marked McCarthy’s bet to attract more customers, cut losses and improve cash flow. For 2022, IATA said the improved prospects stem largely from strengthened yields and strong cost control in the face of rising fuel prices. Just like people have favourite watches or shoes, some investors have favourite stocks which they are unwilling to let go even if it continues to erode capital from their portfolio.

Add a touch of gold to your portfolio

The IATA and McKinsey has published a study on the profitability of the airline value chain. In the Asia Pacific region, airlines are projected to post a loss of $10 billion this year and the loss is expected to narrow to $6.6 billion in 2023. “Passenger yields are expected to grow by 8.4 per cent (up from 5.6 per cent anticipated in June). Propelled by that strength, passenger revenues are expected to grow $438 billion (up from $239 billion in 2021),” it noted. After being significantly impacted by the coronavirus pandemic, the airline industry is on the recovery path. The government’s decision in November 2016 to scrap Rs 1,000 and Rs 500 notes and replace them with new notes led to a severe cash crunch.

Uniper boss tells investors to back German bailout or risk all

While avoiding the loss might not always be possible but minimizing the losses is certainly in your hands. Setting stop-loss and profit targets are essential to being a successful trader. One can make a fortune even with a higher loss–win ratio when the rule is applied while trading in an unpredictable market.

If you enter the market without knowing why you are entering the market, then there exists no difference between a trader and a gambler. Learn as much as you can about different businesses as at the end of the day we are in the business of businesses. I am willing to open a Demat Account with Angel One to start investing in these top picks.

In the book ‘Market wizards’ by Jack Schwager, the great Peter Brandt has said he presumes that while making trading decisions he will be incorrect around 65% of the time. That’s quite several failed trading decisions but he has been able to make millions for his firm which is only possible through ‘cutting losses and riding profits’. It is seen and believed that the stock index will always end up higher in the long term.

The reason is that after hitting your stop loss, your mind first wants to recover the losses, and then only you can make some profits. In this scenario, you must make twice the money as you were planning to earn before, which will eventually drag you to lose more money in the market. I will tell you some of the important points that have helped day traders to cut losses. Accept Blame When RequiredA loss in the share market can often deliver not just a blow to one’s finances but to one’s sense of self-worth as well. Investors can often find it difficult to come to terms with the fact that they made an error in judgement with respect to a stock position. As a result, it can seem easier to direct the blame for the losing stocks at external factors, such as market conditions.

Leave a reply →