Forex Market Timings: RBIs Draft Suggests Change In Forex Market Timings, Money Market Hours

Contents

Currently, inter-bank trading hours in USD/INR are longer than customer window by 30 minutes . The Reserve Bank has been receiving suggestions to allow banks to extend USD/INR trading window to corporates beyond 4.30 pm. The IWG explored the feasibility of aligning inter-bank and customer window. Banks are of the view that the gap between inter-bank and customer window is needed to cover customer positions in the inter-bank market.

If you want to trade currency pairs like EUR/USO, GBP/ USD, or USD/CHF you will find more activity when both Europe and the United States are active. In India, investors can trade in assets and securities even after the stock markets close. Do note that in the after-hours trading sessions, you cannot actively trade in the markets. Instead, you can place an order to buy or sell your securities.

This means trading happens only over weekdays but is on for 24 hours on those days. Remember, high trading activity also leads to high volatility. While the volatility creates opportunities for profit-making but it may also lead to huge losses if your trading strategy is flawed.

→ What Is Forex ?

However, as per market feedback, extension may not have benefits commensurate with increase in costs, at least initially. Trading hours should be adequate for corporate, retail and institutional customers including non-resident participants, to meet their daily business requirements. Inter-bank participants, consequently, should be able to cover their positions after meeting the requirements of customers. These changes have contributed to a rapid development of the market. Participation across the three overnight markets varies. The call money market is purely an inter-bank market with the sole exception of primary dealers .

The forex market is one of the only financial markets that have the luxury of remaining open over a 24 hour, 5 days a week period. They monitor multiple economic calendars and trade aggressively on every data release, considering the 24×7 foreign currency market as a convenient way to trade throughout the day. This method has the potential to not only quickly deplete a trader’s capital, but also to burn out even the most stubborn trader. Although the Forex market can be traded basically 24/5, the best market liquidity, volatility, and trading conditions are generally experienced during the London session and early U.S. session. Functions trading under specific time standards in India.

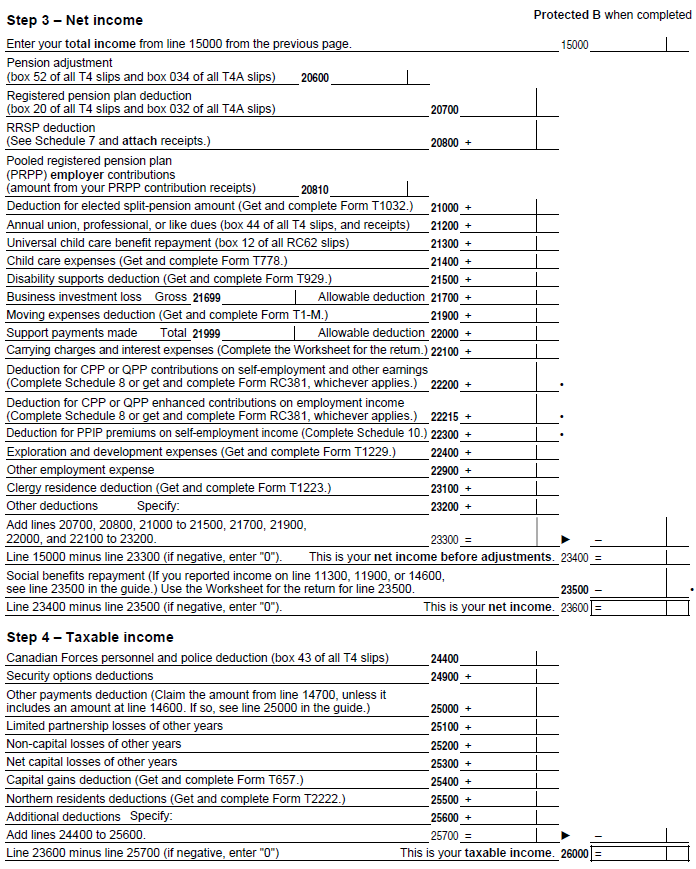

- The table shows CFD and Forex trading hours by types of trading instruments.

- A comprehensive review of timings in the forex market is considered desirable for the reasons discussed here.

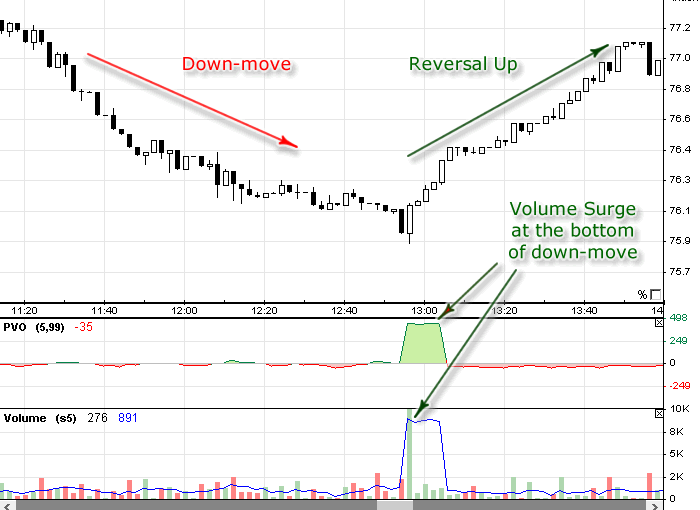

- The added volatility that comes from such releases can lead to greater opportunities, but the risks are also higher.

- Considered as minor markets, they are busy financial centers with significant FX activity.

Beginner currency traders may be enticed by the prospect of making huge deals with a tiny account, but this also implies that a small account might lose a lot of money. The market’s technology infrastructure matches contradictory orders from market makers, individual traders, and other liquidity providers to execute each FX exchange. When a trader places a buy or sells order in the market, forex brokers help the trader by providing margin. As a result, the trader is able to create fresh positions with significantly more capital than he has on hand, with the intention of profiting from favorable market changes. You can trade forex in India with exchanges such as NSE, BSE and MCX-SX.

Market Timings Changed: Know New Working Hours Of G-Sec, Forex, Commercial Paper Segments

This is the primary Indian share market timing lasting from 9.15 a.m. Any transactions made during this time follows a bilateral order matching system, wherein CEO vs. President: What’s the Difference price determination is done through demand and supply forces. This time acts as a transition period between pre opening and normal Indian share market timing.

That said, there is a significant overlap in the market hours for trading either currency type. Here’s a detailed explanation of the forex market hours for INR pairs and cross-currency pairs. The FOREX market is open 24 hours a day, nearly 6 days a weekthat does not depend on certain business hours of foreign exchanges; trade takes place among banks located in different corners of the globe. Exchange rates are so flexible that significant changes happen quite frequently, which enables to make several transactions every day. Since the early 1970s, with increasing internationalization of financial transactions, the foreign exchange market has been profoundly transformed, not only in size but in coverage and mode of operations. In a universe with a single currency, there would be no foreign exchange , no foreign exchange rates, and no foreign exchange.

These markets have evolved in last years in terms of participation, liquidity and venues of trading etc. Most of these markets are dominated by institutional players and corporates with low participation from retail participants. Technology has helped in further deepening of these markets, with most of the trading volumes in overnight money market and G-sec market now carried out on electronic platforms. This chapter discusses, in detail, the structure of each of these markets. The results of empirical studies undertaken by the Group on linkages of rupee NDF and onshore exchange rate market are given in Annex-I. A summary of the literature studied by the Group is furnished in Annex-II.

Cross-Currency Trading Timing in India

Experience from some of the exchanges viz., Hong Kong Exchange , points to positive impacts on the volume on account of extension of market timing. Better price discovery coupled with improved liquidity over a medium to long term horizon, may allow domestic market prices to become less prone to external price fluctuations in Rupee. Total investment by Foreign Portfolio Investors /Foreign Direct Investors in India has grown significantly in the last years. However, onshore hedging activities of non-residents have been low with forward outstanding currently at around USD 6 billion as compared to the investment at USD 80 billion.

There are two distinct segments of OTC foreign exchange market. One segment is called as “interbank” market and the other is called as “merchant” market. Interbank market is the market between banks where dealers quote prices at the same time for both buying and selling the currency. In majority of the “merchant” market, merchants are price takers and banks are price givers.

As a result, you must understand the significance of the quotes for the currency you’re trading, or you risk losing money unintentionally. Foreign currencies fluctuate in value against one another https://1investing.in/ on a daily basis. Traders can profit from these moves, just like they can profit from anything that changes value. The currency market is open 24 hours a day, making it extremely liquid.

Ready to Trade?

Forex trading takes place around the clock worldwide, starting on Monday morning New Zealand time and closing Friday afternoon New York time. In order to offer a competitive trading environment, EUREX has extended the trading hours to cover a trading time of 23 hours. Forex futures market was extended in Feb 2017 and forex options market was extended with effect from 2 July 2018. In several jurisdictions there is no gap between inter-bank and customer window. Currently also, AD banks are permitted to accept retail transactions in USD/INR beyond 5 pm. There are no time restrictions for transactions in cross currencies.

Not only can this strategy deplete a trader’s reserves quickly, but it can burn out even the most persistent trader. The currency trading time in India is from 9.00 AM to 7.30 PM. INR currency pairs can be traded till 5.00 PM while some cross-currency pairs can be traded till 7.30 PM. The forex market in India will be closed for 19 days in 2023.

Why is the Forex Market Considered 24 Hours?

A) Globally, OTC forex markets in major currencies are open round the clock. The growing volumes in Rupee on offshore exchanges (Chart 3.1 above) indicate that there is reasonable offshore demand for Rupee exposure. Further, internationally forex markets are quite active when New York and London times overlap, but the domestic Rupee market is closed during these hours. Extension of trade timing could help in effective assimilation of international developments and help make the domestic markets less prone to the to external price fluctuations in Rupee. This would also imply effective exchange rate management policy. In India, forex trading is primarily an OTC Market, wherein trades are conducted between two known counterparties.

Moreover, a skewed trading pattern in NASDAQ i.e., high trading volume – especially at the open and close of the regular-hours – calls for extension of trading hours to mitigate market inefficiencies . Furthermore, it is found that trading after regular business hours introduces noise resulting in higher bid-ask spreads and inefficient price discovery. Thus, announcements after market hours are likely to generate greater price volatility .

Forex Market Hours

You can see heavy movement in AUD, JPY, EUR, GBP to the USD currency pairs. Margin calls are always called against the Clearing Member. However, margin calls arising from shortfalls on client accounts are calculated separately, with auto allocation of the cash collateral received to the client collateral pool. Eighty-five per cent of HKFE participants participated in the after-hours session. Session’s volume rose from about 4 per cent of the day trading volume in 2013 to about 20 percent . C) Keeping the spot market open would involve costs for participant banks, brokers etc.

A few case studies related to extension of timing on exchanges in a few jurisdictions are given in Annex-III. An overview of risk management measures adopted in some of the major overseas exchanges/clearing houses for extended trading window is given in Annex – IV. CFD and Forex market hours mostly imply the operation hours of world trading markets – London Stock Exchange, New York Stock Exchange, Hong Kong Stock Exchange, Tokyo Stock Exchange and others. Since the markets are situated in various locations and time zones it becomes complicated to track trading hours of various instruments. The situation with currency pairs is easier, since they are not available only on weekends.

The first is domestic, related to a country’s trading hours. For example, a currency pair that has USD as the quote or base may have potentially high liquidity during the US’ currency trading hours. You can invest directly by opening an overseas trading account with a foreign broker or opening an overseas trading account with a domestic broker. Alternatively, you can also invest through mutual funds and ETFs.

They vary based on overlapping trading sessions around the world. The logic is that a currency pair may be subject to more or less trading activity based on two factors. Traders from that country or region are more likely to use their domestic currency en masse during their forex market hours.

Leave a reply →