The Role of Artificial Intelligence in Algorithmic Trading

Contents:

In the 1980s, you had to program your own platform and algorithms, but it is now easier than ever before to algo trade. Whilst programming your own solutions has its perks, you can outsource the programming. There are also a wealth of platforms that handle the bulk of the technical side nowadays. If a stock is listed on multiple markets, its price can vary. The stock can therefore be bought at a lower price and sold on another market where the price is higher, resulting in an arbitrage profit.

Algorithmic Trading Market 2023-2029 Enormous Growth, Detailed … – Digital Journal

Algorithmic Trading Market 2023-2029 Enormous Growth, Detailed ….

Posted: Fri, 14 Apr 2023 07:46:19 GMT [source]

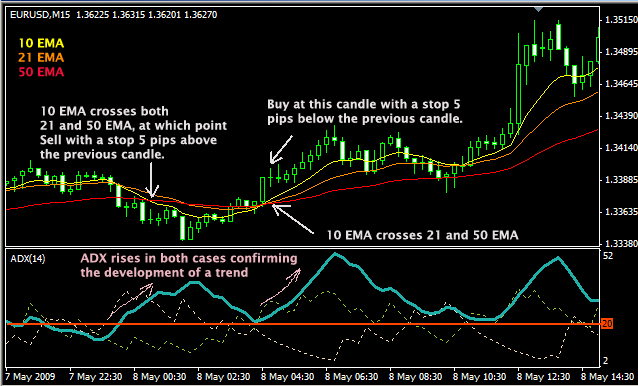

It’s the most popular and simplest way to algo trade. That’s because it has technical indicators for entries and exits that are relatively easy to program as code. You also need computer programming and coding knowledge. Once you have all the knowledge, it takes a lot of time to program the algo and run all your backtesting and paper trading before trying it live. Having an algorithm trade for you potentially can cut out a lot of the time-consuming work of trading.

Conclusion: Is Algorithmic Trading Worth It?

Alameda Research is a crypto trading firm currently managing hundreds of millions of dollars. In its early days, the firm exploited what’s known as the kimchi premium, the price gap between digital tokens on South Korean exchanges and those outside of Korea. Here’s a simple example of arbitrage; a company named Example A, Inc is listed on two stock markets, the London Stock Exchange and the New York Stock Exchange . London and New York are two different cities over 3,000 miles apart, hence a significant time difference. Springer link has a tremendous amount of information on computational finance. The content here is worth noting for algorithmic trading actions.

Algorithmic Trading: Risks and Realities of Smart Investing – Investing News Network

Algorithmic Trading: Risks and Realities of Smart Investing.

Posted: Tue, 04 Apr 2023 07:00:00 GMT [source]

Such a trade is known as a distortionary trade because it distorts the market price. In order to avoid such a situation, traders usually open large positions that may move the market in steps. An arbitrage trading program is a computer program that seeks to profit from financial market arbitrage opportunities.

Algorithmic Arbitrage Trades

If you have computer programming skills or know a bit about coding, you might find success with it. And even if it’s not for you, it’s smart to know what’s going on in the overall market. Let’s say you want to set up your algo to buy breakouts. You would put in a line of code that indicates to buy on new 52-week highs.

- That’s why I prefer to trade penny stocks using the rules I’ve learned in over 20 years of trading.

- When we do that is from live data and we note it as such.

- Technology can now scrutinise large amounts of data across a variety of these criteria, thus being able to identify trends far quicker and more accurately than a human.

- Besides the just mentioned mean reversion strategies, there are many other types of mean reversion strategies.

Some trading algorithms tend to profit from the bid-ask spread. As I had mentioned earlier, the primary objective of market making is to infuse liquidity in securities that are not traded on stock exchanges. Market making provides liquidity to securities which are not frequently traded on the stock exchange. The market maker can enhance the demand-supply equation of securities. We can also look at earnings to understand the movements in stock prices.

Which really just creates kind of a recipe for over optimization. In theory someone could actually trade it with less. I believe over 50% before it would have to turn off. In these algorithms there’s plenty of buffer built into it. Where we use this kind of market direction agnostic design methodology.

The scalping trading strategy commonly employs algorithms because it involves rapid buying and selling of securities at small price increments. Market prices, data and other information available through Alpaca are not warranted as to completeness or accuracy and are subject to change without notice. Okay, so now I’ll start talking about our design methodology. But first I’d like to just comment on predicting market direction and trading algorithms in general. So, obviously no one can predict the market direction with 100% certainty.

Save Time

This algorithmic trading blog by Dom Wells explains and tests arbitrage opportunities on exchanges to help investors take advantage of them and make huge rewards. The algorithmic trading blog gives a step by step procedure for maximum profits. On this site, you will find content that is more complex and most viable for quantitative analysis professionals who operate in hedge funds. Here you will find software information that provides solutions to quantitative trading strategies in Forex, equity and derivative markets. The content provided by Binomo Blog does not include financial advice, guidance or recommendations to take, or not to take, any trades, investments or decisions in relation to any matter. The content provided is impersonal and not adapted to any specific client, trader, or business.

- So that we can compare our strategies to each category to see how they do.

- Now, that our bandwagon has its engine turned on, it is time to press on the accelerator.

- Before you can build an algorithmic trading program, you need to have a plan, just as if you were trading the setup yourself.

- The simplest form of mean reversion would be to use one or multiple moving averages of the stock’s price and trade around the discrepancy between this average and the stock’s price.

- I trade simple predictable patterns, I stick to my rules, and I trade safely.

So put together a portfolio that we have high expectations for moving forward. It’s using this kind of stacked column chart or bar chart. Then we have it categorized in the strong up, sideways or down. You know, just another way of looking at the same data. So when the markets going higher, the iron condor contributes a lot. When the market goes sideways, you can see the iron condor also helps.

The rebalancing offers opportunities for algorithmic traders, who capitalize on expected trades. The rewards depend on the number of stocks in the fund before the rebalancing. Algorithmic trading allows executing trades on time and for the best prices.

Introduction to Algorithmic Trading Strategies

Using an algorithmic trading robot reduces the risk of manual errors so trades can be executed more efficiently. Many types of traders use algo trading, from short and long-term participants to institutional investors. The mathematical, methodical approach is an alternative to manual, sometimes emotion-driven trading. So the purpose of this video is to give everyone a real high level view of what our trading design methodology is.

A New ChatGPT-Powered Bot Named Satoshi Will Soon Help … – Forbes

A New ChatGPT-Powered Bot Named Satoshi Will Soon Help ….

Posted: Thu, 13 Apr 2023 13:53:24 GMT [source]

We haven’t always had the independent third party review. But what we do think we have is a really good suite of algorithms. The day trader is a portfolio that we put together mainly because there are some people that do not want to hold positions overnight or over the weekend. The unit size on this one is $10,000 so each unit trade is 10K. You can see that the amount that this one is expected to make is lower than the others. This package really would be for someone that just really doesn’t want to hold any positions overnight.

Crypto Wallets Explained: Custodial vs. Non-Custodial Wallets

There’s also Algorithmic trading strategist in the forex, options, and futures markets, but to a lesser degree. It’s another reason I stick to volatile penny stocks. The programmer develops a computer code to performs trading activities based on the above two instructions. The computer program is so dynamic that it can monitor the live prices of the financial markets and, in turn, trigger activities as per the above instructions. It saves the trader’s time as they don’t have to go to the trading platforms to monitor prices, and place the trading orders. The trade, in theory, can generate profits at a speed and frequency that is impossible for a human trader.

When the https://forex-world.net/ goes lower, the treasury note does the best. But then we do loose some because of the momentum algorithm right here. The market is either going up, it’s either going sideways or drifting higher or down. Where the market traded down in October of this year. So you can see 08 here when we had that bear market.

Index funds have defined periods of rebalancing to bring their holdings to par with their respective benchmark indices. Such trades are initiated via algorithmic trading systems for timely execution and the best prices. In this article I want to introduce you to the methods by which I myself identify profitable algorithmic trading strategies.

Create and test your own trading algo

Or if it sells off then you’ll get stopped out of the long trades that you take towards the bottom of the range. So, that’s just in general the problem that any algorithm developer faces. So, you want to try to capture the gains when it goes higher. Capture gains when it goes sideways and then capture gains when the market goes lower.

This guide will help you design algorithmic trading strategies. Algorithmic strategies will help control your emotions. It will also help by letting a machine do the trading for you.

In order to measure the liquidity, we take the bid-ask spread and trading volumes into consideration. Your account is fully activated, you now have access to all content. Sign up below to access our Future Winners portfolio, featuring our top crypto picks. Of the financial market and accordingly decides whether to opt for it. If, on the other hand, the general consensus is that the new phone is amazing and enough people express this opinion online, the algorithm might suggest a bullish position.

This is where backtesting the strategy comes as an essential tool for the estimation of the performance of the designed hypothesis based on historical data. It is a perfect fit for the style of trading expecting quick results with limited investments for higher returns. A large number of funds rely on computer models built by data scientists and quants but they’re usually static, i.e. they don’t change with the market.

The continuous fluctuation of markets makes it impossible to sustain a delta neutral portfolio manually; however, algo trading can manage the delta of your position with ease. Trend following practices analyse data to identify trends. These tend to be related to moving averages, breakouts and price fluctuations but could be any technical indicators or concepts that you understand and are comfortable using. Big trades have the potential to manipulate market prices . A larger investor can utilise algo trading to spread a significant trade across a range of smaller trades. In doing this, you can evaluate the effect on market prices as the trade takes place.

Leave a reply →